This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

AT&T-Discovery Raise $30bn via 11-Part Deal; Fourth Largest Ever

March 10, 2022

AT&T and Discovery raised $30bn via a 11-part jumbo bond offering, securing funding for the combination of their media businesses. Details of the issuance are given below:

The bonds were issued via a unit called Magallanes Inc. and are rated Baa3/BBB- (Moody’s/S&P). “Investors were ready for the deal and feel like it is an opportunity to capture the backup in spreads. It is very difficult to do this in the secondary market”, said David Knutson, head of US fixed income product management at Schroders. The deal comes after AT&T said in February that it would be spinning-off WarnerMedia in a deal worth $43bn and merge its media properties with Discovery Inc. The combined company, Warner Bros. Discovery, will have ~$55bn in debt.

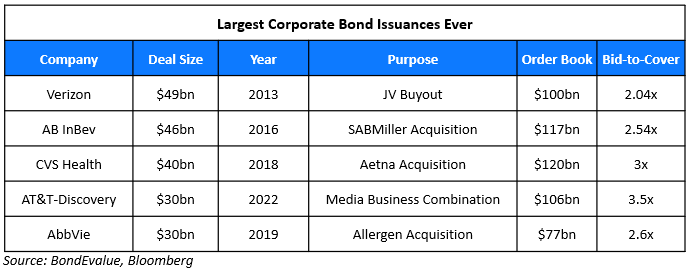

This was the fourth largest deal ever in corporate bond history and saw order books touch $106bn, 3.5x issue size. The $30bn deal was tied with AbbVie’s $30bn issuance in 2019. The table below shows the largest bond deals ever:

For the full story, click here

Go back to Latest bond Market News

Related Posts: