This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

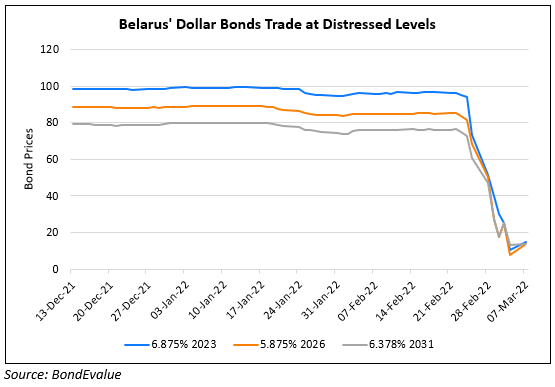

Belarus Downgraded by 4 Notches to Ca from B3

March 11, 2022

Belarus was cut to CCC from B by S&P due to its weakening credit profile amid Russia’s military invasion in Ukraine. Belarus is exposed to significant tightening of sanctions affecting its external buffers and debt servicing capacity. Moody’s expects a default by Belarus being more likely given its willingness to repay debt knowing that “potential financial support coming from Russia will unlikely be used for that purpose”. Moody’s highlights that Belarus’ reserve position stabilized to $4bn in January 2022 is relatively low compared to upcoming debt repayments of ~$2.2bn in 2022 and $3.3bn in 2023. Market and customer confidence has been affected and risks of significant bank deposit withdrawals remain. The rating action follows S&P’s downgrade earlier this week to CCC from B.

Belarus’s dollar bonds are trading at distressed levels of 6-10 cents on the dollar.

Go back to Latest bond Market News

Related Posts: