This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Evergrande Liquidity Concerns Worry Investors with $32bn in Commercial Bill IOUs

July 8, 2021

Evergrande’s liquidity concerns continue as details emerge that the company has $32bn in outstanding commercial bills. Commercial bills are short-term IOUs used for financing purposes. Bloomberg notes that Evergrande has ramped-up issuance of these instruments, which suggests that it is facing a liquidity crunch as banks and investors have avoided long-term funding to the developer. Commercial bills are not technically classified as debt and Bloomberg stated that Evergrande has missed several commercial bill payments this year. “The amount of Evergrande’s outstanding commercial bills is massive…It has apparently become a vital fundraising channel” said Dong Ma, a Beijing-based partner at BG Capital. Overall, Evergrande’s total liabilities (including bills and payables) stood at $301.6bn last year. The update comes as the developer’s total balance sheet debt has shrunk to $88bn, with the company saying that it now meets the Net Debt/Equity threshold among the three red-lines. Lucror’s Zhou Chuanyi says that while the company’s debt has fallen, its payables and bills probably have continued to increase. Yields on Evergrande’s commercial bills are reported to have crossed 35% vs. the 10-20% range seen for Chinese property developers.

Last month, Evergrande said that they will arrange payment of “very small amount” of commercial paper by some affiliates that had not been repaid on time while adding that its operations were normal. “If Evergrande has serious payment difficulties, it would have a sweeping impact across the whole industry chain… Lots of small suppliers’ liquidity would be affected” said Yan Yuejin, research director at E-house China Research and Development Institute.

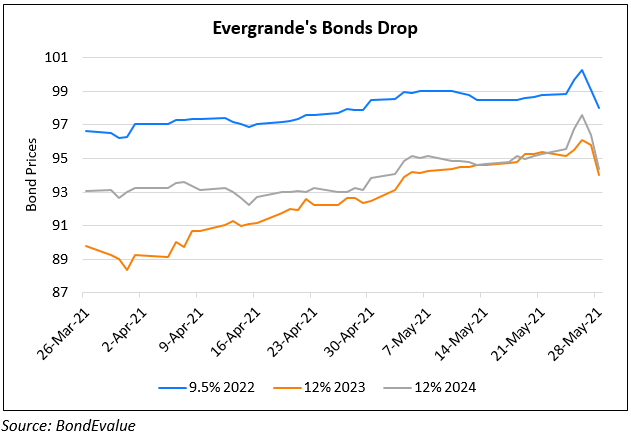

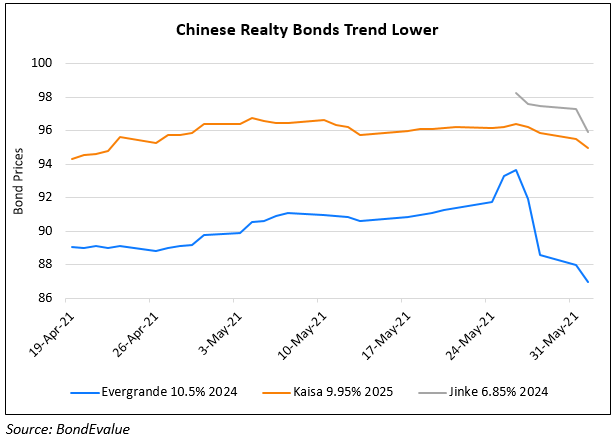

Evergrande’s bonds continue to move lower after falling over 10% this week already – its 11.5% 2022s and 10.5% 2024s were down 7% and 5% yesterday, currently trading at 70.9 and 63.7.

For the full story, click here

Go back to Latest bond Market News

Related Posts: