This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Fantasia’s Bonds Not Being Accepted as Collateral by Citi & Credit Suisse PB Units

September 8, 2021

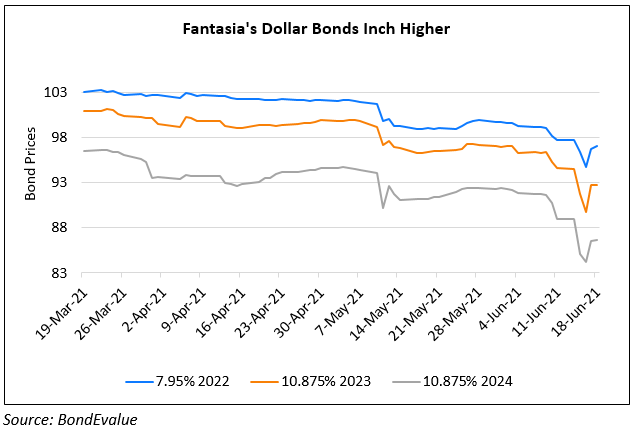

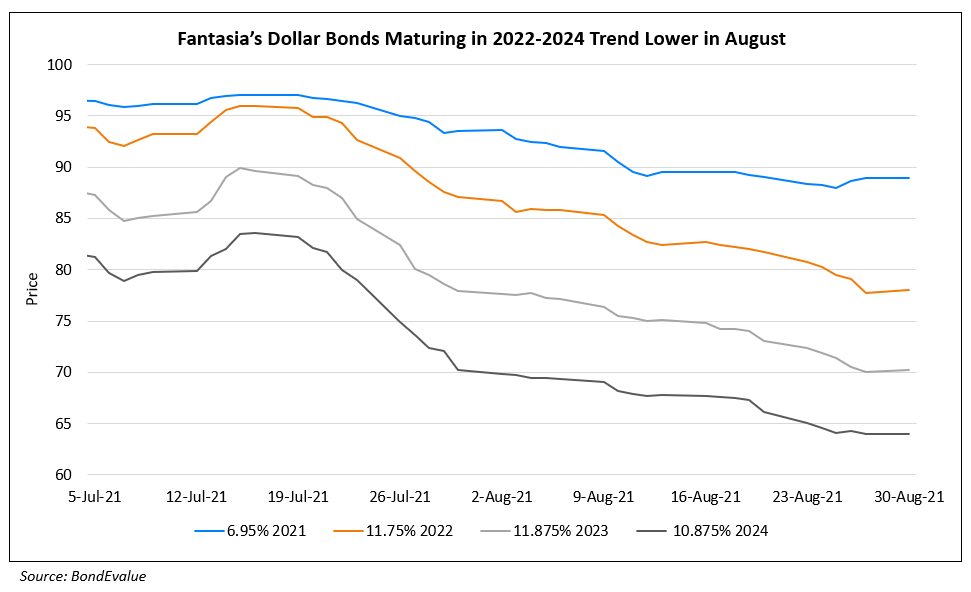

Sources report that private banking units of Citigroup and Credit Suisse AG have stopped accepting bonds of Fantasia after increasing concerns about their financial health. Bloomberg cites sources saying that the two banks have assigned a ‘zero lending value to the notes’. The update comes after Fantasia’s bonds have plunged in recent weeks with Bloomberg reporting that its longer-tenor notes were the worst performers in the Bloomberg index of Chinese HY dollar bonds. Rated B and B2 by S&P/Fitch and Moody’s respectively, the company has $752mn in dollar bonds due through year end, including $208mn in October which are currently trading at 97.7.

Fantasia has bought back $6mn of five separate dollar bonds since mid-August in an effort to calm investor nerves. Fantasia’s 10.875% 2023s are down 3 cents to 50.3 cents on the dollar.

Go back to Latest bond Market News

Related Posts: