This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

How to buy US Treasuries in 4 simple steps. Read More

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Fosun Seeking Selling Stake in Peak Re as Part of Strategic Asset Sales

October 28, 2022

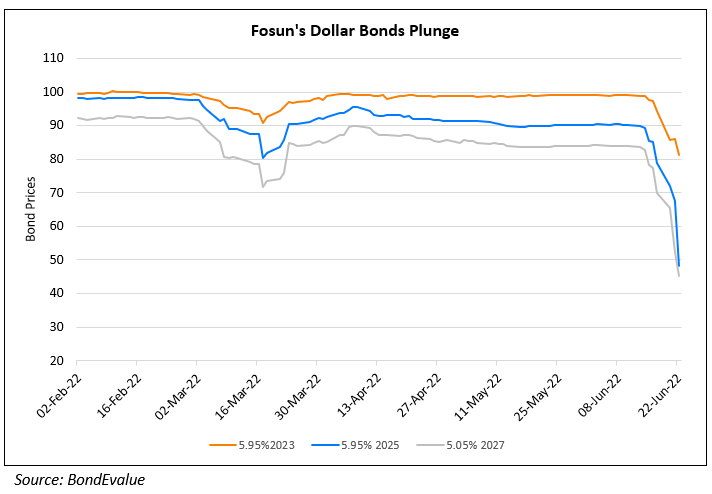

Fosun International is said to be seeking strategic options that include selling either a majority or minority stake in reinsurer Peak Reinsurance in order to pay its debts. Sources said that the transaction which is at early stages, could value Peak Re at $500mn-$1bn, having received preliminary interest from potential buyers including PE firms. Fosun currently holds an 87% stake in the reinsurer, with Prudential Financial holding the remainder. Peak Re focuses on insurance including property and casualty, and life and health with over $2.1bn in gross written premiums at end-2021. The news comes just days after Fosun came out saying that it plans to dispose RMB 50-80bn ($7-11bn) of non-core assets to focus on its consumer-discretionary business.

Fosun’s dollar bonds moved higher with its 5.5% 2023s callable on 25 November 2022, up 2.1 points to 98.25, yielding 7.8%

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Fosun Launches Tender Offer; Redsun, Logan Buyback Bonds

October 12, 2021

Fosun Cuts Down Insurance Stake

September 20, 2022