This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Hopson Launches $ Bond; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

June 21, 2021

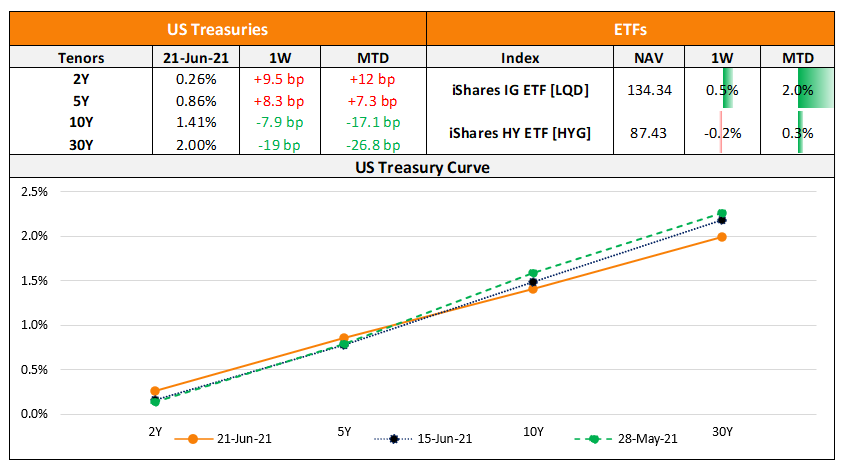

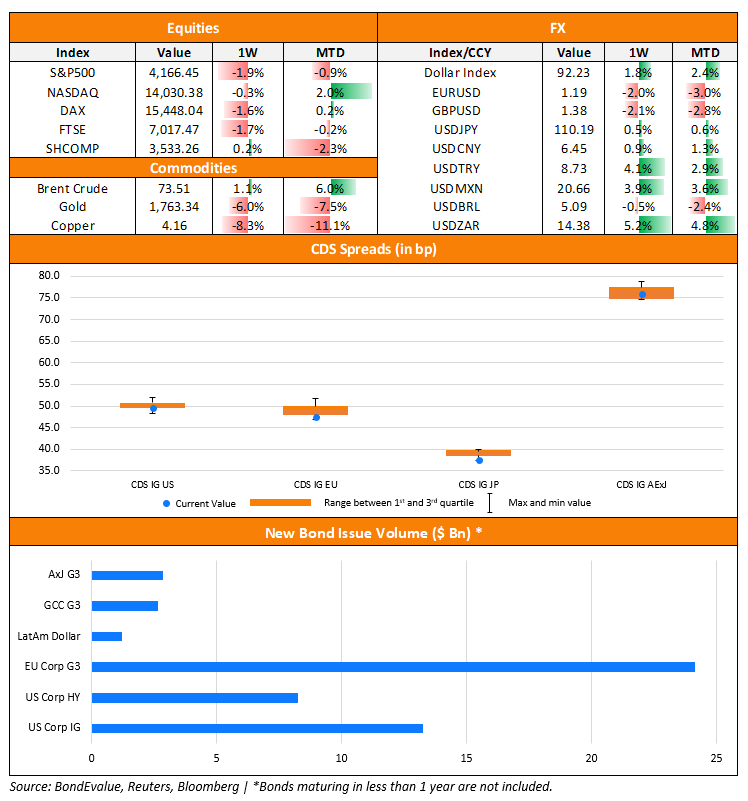

Wall Street ended lower at the close of last week, which was dominated by the FOMC meeting update. S&P and Nasdaq were down 1.3% and 0.9% respectively resulting in weekly losses of 1.9% and 0.3% respectively. Sectors across closed in the red with Energy and Financials leading the drop, down ~2.5%. The yield curve bear flattened (Term of the Day, explained below) on Friday as the US 10Y Treasury yields dipped ~11bp to 1.41% while the shorter dated 2Y and 5Y yields moved higher. European markets also closed lower by ~1.5%. UK’s May retail sales were down 1.4% against expectations of an expansion of 1.6%. Germany’s Producer Price Index (PPI) rose 1.5% in May compared to a forecast of 0.7%. US IG and HY CDS spreads widened 1.3bp and 5.2bp respectively. EU main and crossover CDS widened 1bp and 5.6bp respectively. Saudi TASI fell 0.6% while Brazil’s Bovespa closed 0.3% up. Asian markets opened in the red. HSI was down 1% while Shanghai was marginally down 0.1%. Asia ex-Japan CDS spreads were 0.4bp tighter.

Navigating The Bond Markets by Leveraging the BEV App

New to the BEV App? BondEvalue will be conducting a complimentary session on Navigating The Bond Markets by Leveraging the BEV App on June 23, 2021. This session is aimed at helping bond investors in tracking their investments using the BondEvalue App.

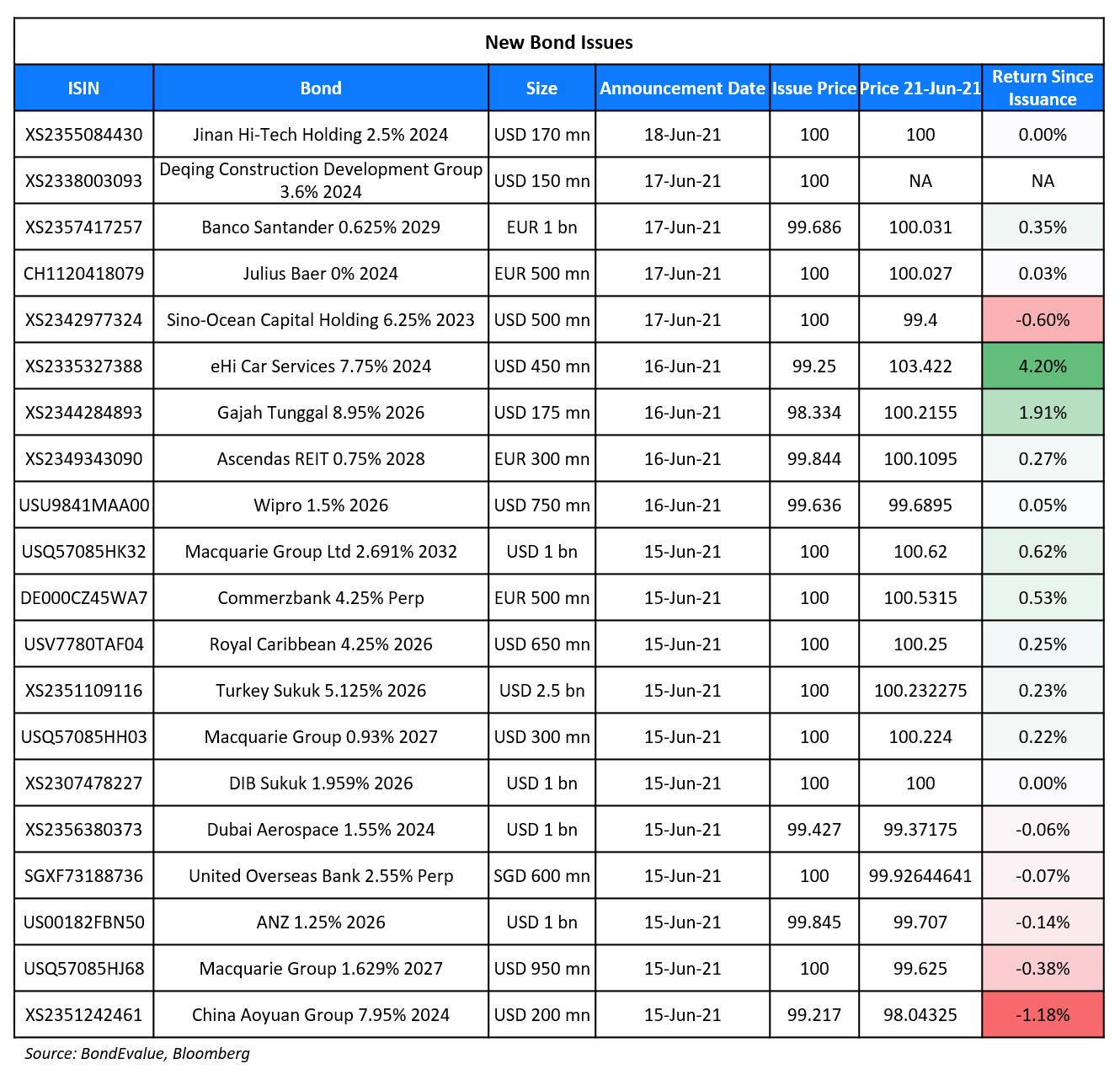

New Bond Issues

- Hopson Development $ 2.5Y at 7.1% area

Jinan Hi-Tech Holding raised $170mn via a 3Y bond at a yield of 2.5%, 50bp inside initial guidance of 3% area. The bonds have expected ratings of BBB.

New Bond Pipeline

- China Oil and Gas Group hires for $ bond issue

- BOCOM International Holdings hires for $ 5Y bond issue; calls today

- RHB Bank hires for $ 5Y or 5.5Y bond offering; calls today

- Mongolia hires for $ senior bond; calls starting today

- CCB (Europe) hires for EUR 3Y bond

Rating Changes

- Shipping Co. Navios Maritime Partners Upgraded To ‘BB-‘ By S&P On Navios Maritime Containers Acquisition; Outlook Positive

- Sichuan Languang Rating Lowered To ‘CCC-‘ By S&P On Heightening Nonpayment Risk; Outlook Negative

- Fitch Downgrades Alpha Holding to ‘C’ on Missed Interest Payment

- Alpha Holding S.A. de C.V. Downgraded To ‘CC’ From ‘CCC’ by S&P On The Exercise Of 30-Day Grace Period For Interest Payment

- Moody’s downgrades Globo’s ratings to Ba2; negative outlook

- Moody’s changes outlook on Vodafone’s ratings to stable; affirms ratings at Baa2

- Fitch Revises the United Kingdom’s Outlook to Stable; Affirms at ‘AA-‘

- Fitch Revises the Bank of England’s Outlook to Stable; Affirms at ‘AA-‘

- ICICI Bank Outlook Revised To Stable From Negative By S&P; Ratings Affirmed

- Fitch Revises Outlook on Logan to Positive; Affirms at ‘BB’

- Fitch Assigns ‘BBB-‘ Rating to JBS USA Lux S.A

The Week That Was

US primary market issuances fell to $21.8bn, down 50% vs. $43.7bn in the week prior led by IG. IG issuances dropped to $13.2bn vs. $34bn in the prior week while HY issuances were up marginally to $8.25bn vs. $7.2bn in the prior week. The largest deals in the IG space were led by Nvidia’s $3.75bn three-trancher and BP Capital Markets’ $2bn two-trancher. In the HY space, Madison IAQ’s $1.73bn dual-trancher and HAT Holdings’ $1bn issuances led the table. In North America, there were a total of 57 upgrades and 26 downgrades combined across the three major rating agencies last week. LatAm saw $1.2bn of new bond deals vs. $1.9bn in the prior week with just two deals – Light Servicos’ and SierraCol Energy raising $600mn each. EU Corporate G3 issuances saw a drop last week to $24.1bn vs. $34.5bn in the week prior – Lundin Energy’s $1.65bn two-trancher led the table followed by NatWest’s €1.25bn ($1.5bn) deal and Santander’s €1bn ($1.2bn) issuance. Across the European region, there were 30 upgrades and 9 downgrades across the three major rating agencies. GCC and Sukuk G3 issuances were lower at $2.65bn vs. $9.15bn in the week prior led by Dubai Islamic Bank’s 5Y bond and Dubai Aerospace’s 3Y deal worth $1bn each, followed by QNB’s $600mn 3Y issuance. Across the Middle East/Africa region, there were 6 upgrades and 1 downgrade across the three major rating agencies. APAC ex-Japan G3 issuances were at $6.1bn vs. $5.8bn in the prior week – Macquarie’s $2.3bn two-trancher led the tables followed by ANZ’s $1bn deal. Other large issuances included Wipro’s debut $750mn 5Y deal, Sino-Ocean’s $500mn 2Y deal and Ascendas REIT’s €300mn 7Y issuance. In the Asia ex-Japan region, there were 3 upgrades and 5 downgrades combined across the three major rating agencies last week.

Term of the Day

Bull Flattening

Bull flattening refers to a change in the yield curve where long-end rates move down faster than short-end rates. This not only has a flattening effect on the entire yield curve but also has a net effect of interest rates moving lower and bond prices moving higher. If the yield curve moves lower and bond prices move higher, it is considered a bull move, while the opposite is a bear move. In last Friday’s move 2Y treasury yields were flat while the 10Y and 30Y yields fell 11-12bp making the 2s10s and 2s30s yield curve flatter led by the 10Y and 30Y yields, a bull flattening move. This can be seen in “The Week That Was” US Treasury Curve chart.

Talking Heads

On US Treasury yield curve flattening as Fed seen more proactive on inflation

Gennadiy Goldberg, an interest rate strategist at TD Securities

“It does seem as though the market has now shifted its view that the Fed’s going to let inflation run wild, to the Fed’s basically going to kill inflation in the cradle.” “The truth is probably somewhere in the middle.” “They are trying to reinforce their control of the narrative. I don’t think they want the narrative to be that the Fed is behind the curve on inflation,” Goldberg said.

James Bullard, St. Louis Federal Reserve Bank President

“We were expecting a good year, a good reopening, but this is a bigger year than we were expecting, more inflation than we were expecting, and I think it’s natural that we’ve tilted a little bit more hawkish here to contain inflationary pressures,” Bullard said.

In a report by Calvin Tse and Kiranpal Singh, Citigroup analysts

Bullard’s comments “are confirmation on the shift at the Fed, which is now more concerned about upside inflationary pressures.”

In a report by JPMorgan analysts

“We think it’s possible long-end steepeners were being used as a positive carry way of positioning for higher yields, especially with the expected Fed liftoff date nearly two years away, and the unwinds of those positions added flattening

pressure.”

pressure.”

Adrian Miller, chief market strategist at Concise Capital Management

“The Fed has been controlling the transitory narrative which has provided confidence to corporate bond investors.” “After all, corporate bond investors are more focused on the expected strong growth path.”

“The Fed has been controlling the transitory narrative which has provided confidence to corporate bond investors.” “After all, corporate bond investors are more focused on the expected strong growth path.”

Andrzej Skiba, head of US credit at BlueBay Asset Management

“For the time being people are not at all fearing the price action of a move higher in yields.” “Companies are doing really well and we are seeing a meaningful recovery in earnings.”

“For the time being people are not at all fearing the price action of a move higher in yields.” “Companies are doing really well and we are seeing a meaningful recovery in earnings.”

Rhys Davies, high yield portfolio manager at Invesco

“It’s very important for us that the yield we receive on a high-yield bond offers an appropriate level of compensation for the credit risks of investing. When yields are as low as this, that naturally becomes harder to say.” “It’s quite simple — the lower the yield on the high yield market, the more carefully investors need to navigate the market.”

“It’s very important for us that the yield we receive on a high-yield bond offers an appropriate level of compensation for the credit risks of investing. When yields are as low as this, that naturally becomes harder to say.” “It’s quite simple — the lower the yield on the high yield market, the more carefully investors need to navigate the market.”

Travis King, head of U.S. investment-grade corporates at Voya Investment Management

“This could lead to some opportunistic 30-year issuance” from high-grade companies.

In a note by Bradley Rogoff and team, Barclays Plc strategists

“While technicals remain strong, a decline in long-dated yields should negatively affect demand from insurers and pension funds, potentially weighing on long-dated investment-grade spreads.”

Vincent Benguigui, a portfolio manager at Federated Hermes

“The market is long because it has loads of cash to deploy and fundamentals are quite strong.” “It’s not a comfortable long though.”

Jochen Felsenheimer, managing director at XAIA Investment

“The next downturn will hit the market much harder as we have more leverage in the system and higher chances of mass defaults due to inflation risks sending rates higher.”

Top Gainers & Losers – 21-Jun-21*

Go back to Latest bond Market News

Related Posts: