This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

May 10, 2023

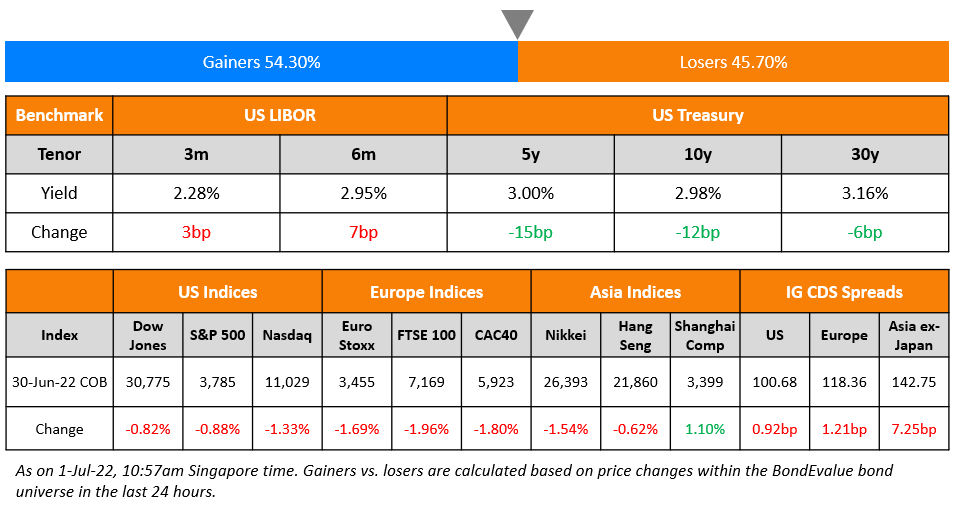

US Treasury yields were broadly flat on Tuesday with no particular direction. Markets now await the April inflation print later today where headline CPI is expected to come at 5% YoY and Core CPI at 5.5%. The peak Fed Funds Rate was up 3bp to 5.12%. While markets still expect no change in policy rates at the Fed’s June meeting, the probability of a 25bp hike has increased over the past week from 0% to 21%. Equity indices were slightly lower with the S&P and Nasdaq down 0.5-0.6%. Also, US IG and HY CDS spreads were wider by 1.1bp and 5bp respectively.

European equity markets ended marginally lower too. European main CDS spread were 1.7bp wider and crossover spreads widened 8.9bp. Asia ex-Japan CDS spreads also widened by 2bp. Asian equity markets have opened broadly in the red today.

New Bond Issues

Eximbank China raised $1.5bn via a 3Y bond at a yield of 4.077%, 40bp inside initial guidance of T+75bp area. The bonds have expected ratings of A+ (S&P), and received orders over $6bn, 4x issue size. Proceeds will be used for general corporate purposes. The new bonds are priced 12.3bp tighter to its existing 2.875% 2026s that yield 4.2%.

Bayfront Infrastructure raised $500mn via a debut 3Y bond at a yield of 4.257%, 15bp inside initial guidance of T+70bp area. The bonds have expected ratings of AAA (S&P) and are guaranteed by the Government of Singapore. It received orders over $1.75bn, 3.5x issue size, with fund managers and corporates snapping up 43%, public sector investors 26%, banks 23%, and private banks/others 8%. Asia accounted for 80%, EMEA 10% and offshore US 10%. Proceeds will be used for general corporate purposes.

NatWest raised €1bn via a 5.75NC4.75 bond at a yield of 4.776%, 20bp inside initial guidance of MS+195bp area. The bonds have expected ratings of A3/BBB+/A, and received orders over €1.75bn, 1.8x issue size. Proceeds will be used for general corporate purposes.

Ford raised €600mn via a 5Y bond at a yield of 6.125%, 25bp inside initial guidance of 6.375% area. The bonds have expected ratings of Ba2/BB+/BB+. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Korea Credit Guarantee Fund hires for $ 3Y Social bond

- Melbourne Airport hires for € 10Y bond

Rating Changes

- Casino Guichard – Perrachon Downgraded To ‘CCC-‘ On Rising Restructuring Risk And Weak Liquidity; CreditWatch Negative

- Ghana ‘SD’ And ‘CCC+’ Ratings Affirmed; A Further Eight Eurobonds Downgraded To ‘D’ On Missed Payments

- Fitch Downgrades Credivalores’ IDR to ‘B-‘; Outlook Negative

Term of the Day: Consent Solicitation

Consent solicitation is an offer by the issuer to change the terms of the security agreement. These are applicable for changes to bonds or shares issued and can range from distribution payment changes and covenant changes in bonds to changes in the board of directors with regard to equities.

Talking Heads

On Premature for Fed to call end to rate hikes with inflation still high – NY Fed’s John Williams

“We haven’t said we are done raising rates… We’ve made incredible progress… if additional policy firming is appropriate, we’ll do that… In my forecast I see a need to keep a restrictive stance of policy in place for quite some time”

On Wall Street Leaders Warning of ‘Unthinkable’ Fallout If US Defaults – TBAC

“The short-term impacts of a protracted negotiation are costly; the long-term implications of a default are unthinkable… time to introduce an alternative method of enforcing fiscal responsibility, by either requiring the limits to be raised simultaneously with appropriations or by repealing the debt limit altogether”

Beth Hammack, Goldman’s co-head of global financing

“There is real risk to the US dollar. Anything that moves us away from being viewed as the world’s reserve currency, of being the safest most liquid asset in the world, is bad for the American people”

On US on Brink of a Recession, Sees Hard Landing – Stan Druckenmiller

“I am not predicting something worse than 2008… it’s just naive not to be open-minded to something really, really bad happening. You’re going to have unbelievable opportunities in the next couple of years. There’s a lot of dispersion within industries, and just make sure to preserve your capital until they present themselves”.

On Credit Markets Having a Math Problem – King Street’s PM, Paul Goldschmid

“There’s a huge math problem in credit right now” Companies with B ratings tend to be levered about 4-8x… risk-free rates have gone from zero to 500bp in months, creating a precarious situation for companies staring down maturities… “Real estate is one of those things right now where things are starting to crack… keep on asking yourself, ‘is this the time to provide capital?”

Top Gainers & Losers – 10-May-23*

Other News

CK Asset makes $612.9mn offer to acquire London-listed Civitas Social Housing

Go back to Latest bond Market News

Related Posts:.png)