This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

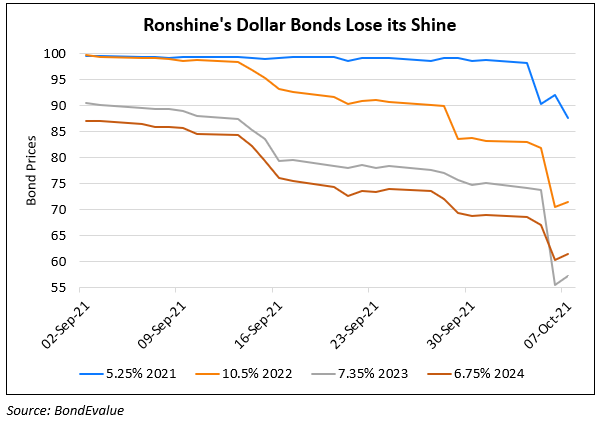

Ronshine China’s Dollar Bonds Plummet

October 7, 2021

Dollar bonds of Ronshine China plummeted as contagion risks continue to weigh on lower rated Chinese HY developers. Ronshine’s 7.35% 2023s crashed 25% yesterday to 55 cents on the dollar and its Ronshine 10.5% 2022s fell 14% to 70.5 cents. Fitch had downgraded Ronshine two weeks ago to B+ from BB- reflecting weak profitability, low EBITDA margins and return efficiency as compared with similar rated peers. In mid-September, S&P downgraded the company to B from B+ citing similar reasons which can ultimately hamper deleveraging. Following S&P, Moody’s also downgraded the developer to B2 from B1 on similar reasons. Moody’s added that Ronshine has a large amount of debt with $1.5bn of dollar bonds and RMB 9.4bn ($1.5bn) of onshore bonds maturing or becoming puttable from September 1, 2021 to December 31, 2022 with its senior unsecured rated a notch lower at B3 due to structural subordination risks. Ronshine had RMB 27.3bn ($4.2bn) in unrestricted cash of as of the end-June 2021, which covered 109% of its short-term debt. Ronshine’s $150mn 5.25% bonds due December 3, 2021 have fallen 10.5 points this week to 87.71.

Go back to Latest bond Market News

Related Posts:

Ronshine Downgraded by Moody’s to B2

September 17, 2021

Ronshine Downgraded to B+ by Fitch

September 27, 2021