This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

US Sets Record Low Junk Bond Coupon with Centene’s Issuance

June 28, 2021

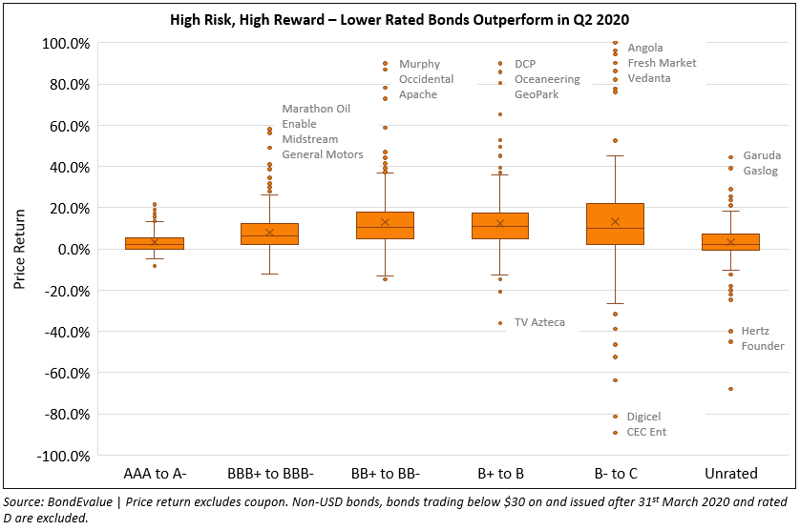

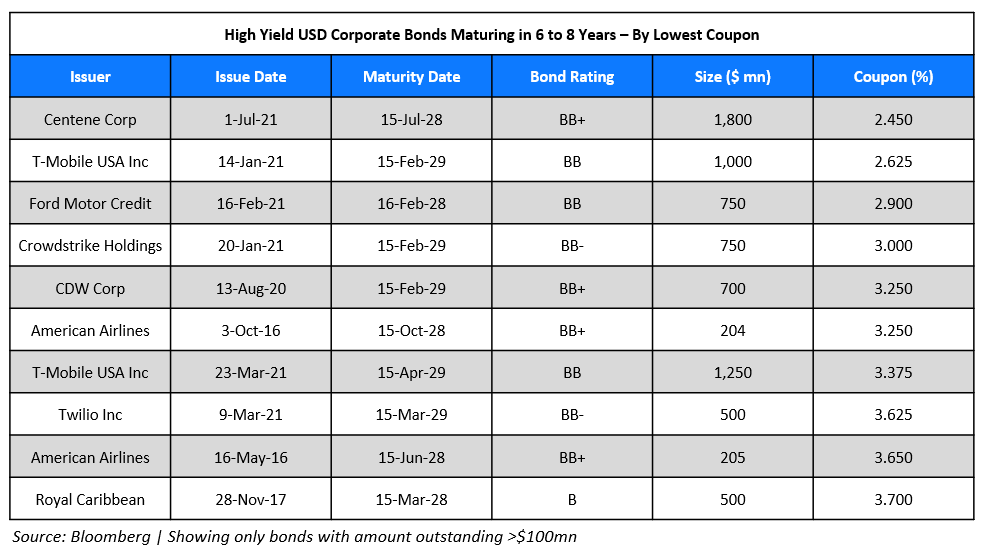

US junk or high yield (HY) bond coupons hit a record low with Centene Corp’s $1.8bn 7Y bond that was issued to offer a coupon of 2.45%. While Centene is considered investment grade with issuer ratings of BBB-/BBB-/Ba1, its new 7Y bond that set the record for the lowest coupon is considered high yield as it is rated BB+/Ba1 by Fitch/Moody’s and BBB- by S&P. HY issuance volumes MTD are at $34bn and saw a record $47bn in issuances in May, the highest ever for the month of May in any year. Bloomberg reports that low funding costs and an increase in oil prices have encouraged companies to seek access to debt capital markets. The supply is met with strong demand from investors despite concerns on inflation picking up, which can cause price losses, Bloomberg notes. HY bonds’ yield-to-worst based on the Bloomberg-Barclays US Corporate HY Index currently stands around record lows of ~3.87%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: