This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

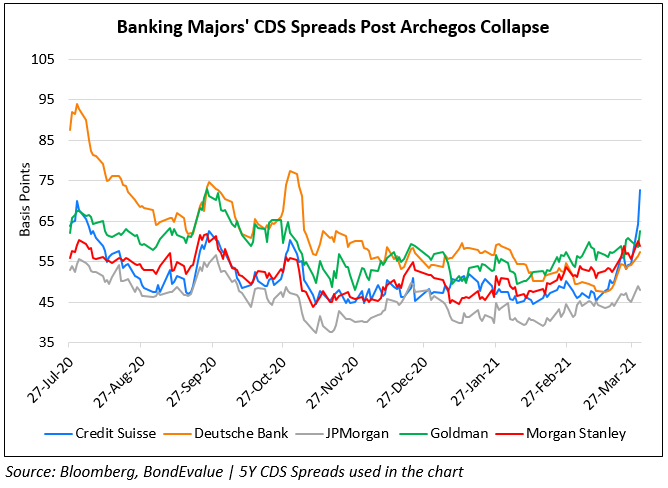

CS Sells $2.3bn of Stock Linked to Archegos; Risk Chief and IB Head Leave

April 6, 2021

After the recent Archegos Capital related collapse impacting Credit Suisse’s financials, ET reports that CS has unloaded about $2.3bn of stock tied to Archegos yesterday to salvage some of its expected losses. The sale comprised about 34mn shares in ViacomCBS, 14mn shares of Vipshop and 11mn shares of Farfetch. Sources also say that CS’s Chief Risk Officer (CRO) and Investment Banking Head are set to leave the company. The head of equities sales & trading meanwhile is stepping down from the role immediately. FT reports that CS calculated its clients could lose upto $3bn from supply-chain funds from the earlier collapse of Greensill Capital and estimates suggest upto $4bn in losses from Archegos.

CS’s USD 5.1% Perp is down 2.3% since the Greensill episode to 97.78, yielding 5.4% while it’s USD 7.5% Perp is down ~4% in the same period to 108.5, yielding 5.08%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: