This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

July 2021: 52% of Dollar Bonds Traded Higher with IG Outperforming

August 2, 2021

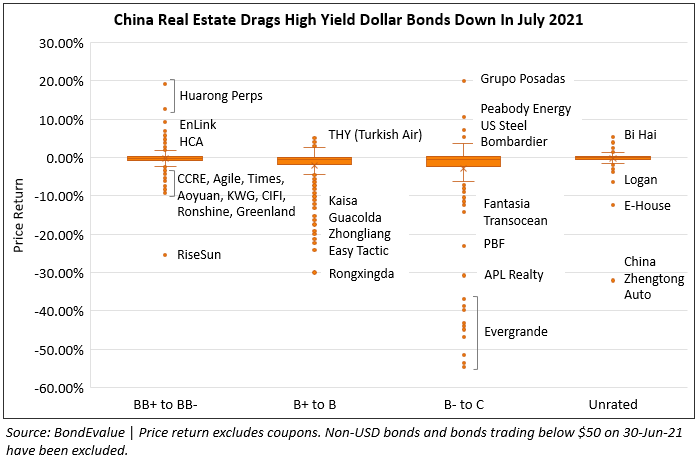

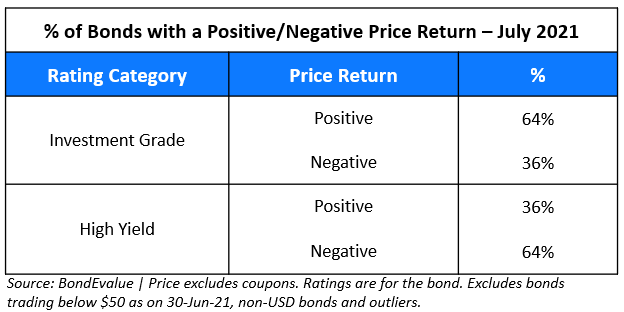

The month of July saw a continuation of June’s move with 52% of dollar bonds in our universe delivering a positive price return ex-coupon during the month as compared to 54% in the prior month. But, unlike June where both Investment Grade (IG) and High Yield (HY) bonds traded in tandem (53% and 55% of IG & HY moved higher in June), July saw IG outperform with 64% of dollar bonds in the green. HY in comparison had a rather gloomy month with 64% of dollar bonds in the red.

The drag in the HY space was dominated by China real estate developers, led by China Evergrande’s dollar bonds that dropped over 50% and peers like Rongxinda, RiseSun, R&F Properties, Fantasia, Yuzhou also dropping sharply in the month (see Gainers & Losers table below). Florian Schmidt, CEO of debt consultancy firm Frontier Strategies said, “China property bonds tend to bifurcate in times of negative credit news when liquidity is switched from single-Bs into BBs. Furthermore, negative news or rating actions applied to a specific credit tends to affect bond spreads of other industry players in the high-beta single-B segment. There is a mix of idiosyncratic and systemic risk factors at play.” Tightening credit conditions, increased focus on China’s ‘three red-lines’ policy and continued scrutiny over the banking and real estate sectors’ relationship have seen the property sector’s dollar bonds take a toll. To read about the impact on the property sector in detail, click here.

In the IG category, the prominent loser was China Huarong’s bonds. Huarong’s bonds rallied mid-month as the company prepared plans to redeem its 2.875% Perp, likely boosting traders’ confidence of the company’s liquidity as they are yet to reveal their 2020 annual results. But the move was only short-lived as Huarong’s bonds fell over 10% in the last week with Moody’s extending its review for a downgrade on the asset manager. Among the top IG gainers were US universities Tufts, Pepperdine and USC.

Issuance Volume & Largest Deals

Global corporate dollar issuance volume stood at $76.5bn for July 2021 marginally up 1% vs. last July’s issuance of $75.6bn and 42% lower than the prior month’s issuance of $131.5bn. July’s issuance is the lowest monthly issuance thus far in 2021, and barring the holiday month of December 2020, issuances last month were the lowest since July 2020.

APAC ex-Japan & Middle East G3 issuance stood at $37.4bn, 20% lower vs. last July’s issuance of $46.9bn, and 47% lower than June 2021’s issuance of $70.6bn. With tighter credit conditions across China, particularly China real estate, HY issuances dropped 62% MoM in July to only $5.4bn.

The largest deals last month were dominated by Qatar Petroleum’s debut $12.5bn jumbo four-trancher, SoftBank’s $7bn multi-currency EUR and USD 8-part deal and Apple’s $6.5bn four-trancher. Other large deals included VMWare’s $3bn dual-trancher and Venture Global’s $2.5bn dual-trancher. Carnival Corp also raised $2.406bn via a 7Y to fund the buyback of up to $2bn of its outstanding 11.5% 2023s via a tender offer which would help it save $150mn per year in interest costs.

-png.png)

In the APAC & Middle East region, Qatar Petroleum’s issuance marked the largest deal and matched Saudi Government’s $12.5bn three-trancher issued in September 2017. SoftBank’s issuance was the second largest deal from the region YTD. Philippines raised $3bn via a two-tranche offering and Temasek raised $2.5bn via a three-trancher to mark some of the region’s largest deals. Other notable issuances were Nomura’s $2bn two-part offering, BOCOM’s $1.5bn 10Y and Xiaomi’s $800mn 10Y deals.

Top Gainers & Losers

The top losers were dominated by Chinese real estate names. China Evergrande led the pack, losing over 50% of its value in the month of July after several negative news events saw its bonds take a toll. The month began with Moody’s downgrading the developer to B2, post which liquidity concerns emerged after it was revealed that they had $32bn in commercial bills outstanding. A few days later, a court ordered a freeze on its bank account held by its subsidiary Hengda Real Estate Group and its unit at China Guangfa Bank. Although the company later resolved the dispute, top Hong Kong banks were said to be considering halting of mortgage loans to Evergrande’s customers. Bonds continued to drop with S&P and Fitch downgrading the company by two notches each to B- and CCC+ respectively. This had a cascading effect on other property developers such as Rongxingda, RiseSun, R&F Properties (Easy Tactic), Zhongliang, Kaisa and Fantasia, to name a few.

Among the gainers, Mexican hospitality company Grupo Posadas saw its bonds jump 20% after the company added several hotels to its portfolio of projects to reconfigure its portfolio to maximize its liquidity and financial flexibility. China Huarong’s 2.875% Perp rallied towards par as the company prepared plans to redeem the bond on its call date of September 14.

Go back to Latest bond Market News

Related Posts: