Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

Petrobras Board Agrees to 50% Dividend Payout

Petrobras' board agreed on a 50% extraordinary dividend payout from 2023, agreeing on a compromise from investors who wanted a 100% payout. The total outflow would amount to ~$4.23bn to its shareholders, including the government. This comes after pressures from...

Standard Chartered Faces $1.9bn Claims on Sanction Breach Claims

Standard Chartered (StanChart) is facing investor claims worth £1.5bn ($1.9bn) over allegations that it breached Iranian sanctions to gain new business. The bank told watchdogs that it processed hundreds of millions in clearing transactions between 2008-2014 through...

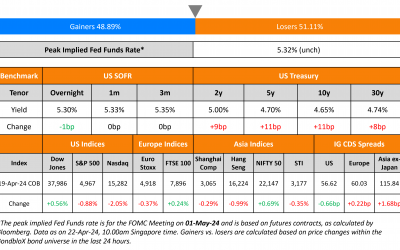

Treasury Yields Jump Higher; Equities Continue to Drop

US Treasury yields surged higher across the curve, as volatility continued to weigh on markets. Yields were higher by 9-11bp across the curve, reversing a a risk-off rally in Treasuries earlier last week due to Middle East geopolitical tensions. Richmond Fed President...

Ghana Expected to Reach Restructuring Deal by May End

Ghana and its creditors are expected to reach a restructuring deal for $13bn of its offshore debt by the end of May, according to sources. A committee of bondholders and government representatives are waiting for the IMF to approve its updated economic review, before...

The Week That Was (15 – 21 April, 2024)

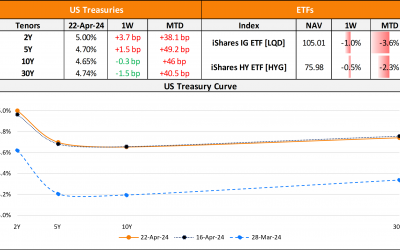

US primary markets were muted again last week, with new deals at $36.9bn, double the $18bn seen a week before. IG issuers racked up $29.6bn of the total with big banks dominating the tables post their earnings - JPMorgan and Morgan Stanley raised $9bn and $8bn via...

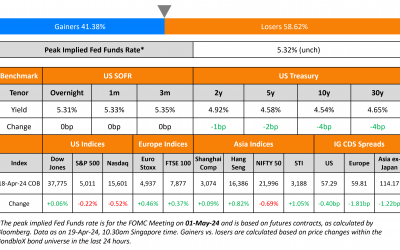

Treasury Yields Tick Further Lower on Geopolitical Risks

US Treasury yields edged further lower across the curve, as Middle East geopolitical tensions continue to weigh on markets. As per reports, Israeli missiles have hit a site in Iran, days after the latter launched a retaliatory drone strike on Israel. New York Fed...

Nordstrom Evaluating Founding Family’s Privatisation Deal

Nordstrom's founding family has shown interest in exploring a privatization deal, according to the company's press release. The move came by the CEO Erik Nordstrom and its President Pete Nordstrom as the company was exploring avenues to enhance shareholder value...

Israel Downgraded to A+ by S&P

Israel's long-term ratings were downgraded by a notch to A+ from AA- by S&P. The downgrade comes due to an increase in confrontation with Iran highlighting elevated geopolitical risk for the country. S&P expects that a wider regional conflict will be avoided....

Telecom Italia Begins €5bn Debt Exchange

Telecom Italia has commenced the debt exchange offer for some of its EUR and USD-denominated bonds to the unit controlled by KKR & Co, that will buy its network. Telecom Italia in November 2023, had agreed to sell its landline network to KKR for about €19bn plus...