Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

Adani Gets Supreme Court’s Clean Chit on SEBI Probe

Adani Group was given a clean chit by the Supreme Court regarding the probe being done by SEBI on Hindenburg Research's allegations. Delivering the judgement, the bench said there are no grounds to transfer the probe from SEBI to Special Investigation Team (SIT) and...

Indonesia Launches $ Bonds; UBS, Santander, Lloyds and Others Price $ Bonds

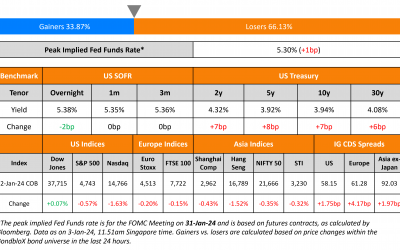

US Treasury yields jumped higher by 7-8bp across the curve. Primary markets saw a flurry of new issuances with US high grade issuers raising over $29bn yesterday. The peak Fed Funds Rate was 1bp higher at 5.30%. Markets await the ISM Manufacturing print later today,...

Vedanta Approaches Deadline Date for Bondholders Debt Overhaul Approval

Vedanta Resources would need at least two-thirds of its dollar bondholders to approve the company's proposal to restructure its bonds. A bondholder meeting will be held on January 4. Vedanta's consent solicitation launched last month indicates their offer to pay...

Argentina and IMF Near Bailout Agreement: Sources

Argentina and the IMF are close to an agreement over a seventh review of its $44bn bailout programme, as per sources. The IMF delegation is scheduled to arrive in Argentina on January 4. The review was originally scheduled in November but got delayed due to...

Dish Completes the Merger With Echostar

Dish Network Corp. and Echostar Corp. have completed their merger, closing the deal on December 31. Post the merger, Dish, which has significant debt and needs around $16bn in new capital over the next 3 years, will now have access to more cash and time to expand its...

Adani Green’s Board Approves $1.12bn Raise via Share Warrants

Adani Green Energy's board approved a plan to issue share warrants to its founders and raise INR 93.5bn ($1.12bn). The money raised will be used to pare debt and fund accelerated capex. Last month, it was reported that Gautam Adani and his family were planning to...

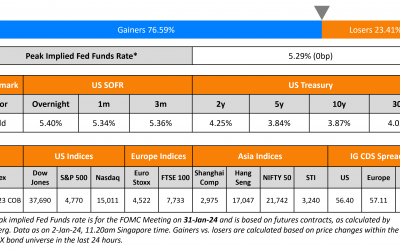

Treasuries Hold Steady; Markets Currently Price 150bp in Fed Cuts

US Treasury yields have begun the new year unchanged over the prior trading day, with the 2Y yield at 4.25% and the 10Y at 3.87%. The US Treasury continued to issue 2Y, 5Y and 7Y notes as part of its auction calendar last week. Weekly jobless claims in the US rose...

Carnival Corp Upgraded to BB- by S&P

Carnival Corp. was upgraded by two notches to BB- from B by S&P on December 22. The upgrade comes back on strong operating results posted by the company for the fiscal year 2023. The company ended the year with an EBITDA of $4.2bn and adjusted net debt-to-EBITDA...

Kenya Pays Coupon on Eurobonds and Scraps Buyback Plans

Last week, Kenya made the interest payment of $68.7mn on schedule for its 6.875% 2024s, maturing in June. Subsequently the country abandoned its plan to buy back $300mn of the total $2bn outstanding principal for the bond. Ruto's government initially had planned a...