Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

KKR-Telecom Italia Deal Checked by EU Regulators for Market Impact

Antitrust regulators in the EU are checking if the deal between KKR and Telecom Italia could lead to a larger impact on Italy's wholesale network market. This comes as KKR is buying Telecom Italia's domestic landline network for ~$23.5bn. Telecom Italia's landline...

General Motors Reports Upbeat Q1 Results

General Motors (GM) on Tuesday reported its 1Q 2024 results, better than estimates, as a result of stable pricing and demand for its gasoline based vehicles. The company's revenue increased 7.6% YoY to $43bn, topping estimates of $41.9bn and its net profit increased...

CK Hutch, Abu Dhabi Price $ Bonds

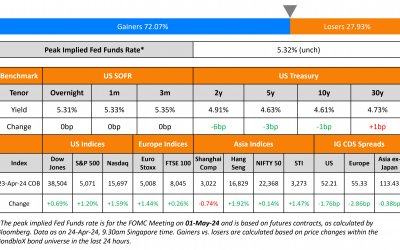

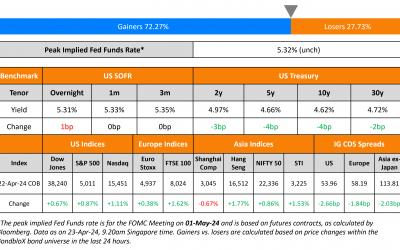

US Treasury yields eased slightly across the curve. US business activity expanded in April at the slowest pace yet this year, as the S&P Composite PMI fell 1.2 points to 50.9. Manufacturing entered contraction territory, with the Flash Manufacturing PMI slipping...

Lai Sun Considering Stake Sale for London Project

Lai Sun is considering exit options for its 100 Leadenhall Street project in London, including a potential stake sale in it. As it is currently in early stages, there is no certainty that the sale of part or all of the project would be ultimately pursued. As per...

Seazen Downgraded to B by S&P

Seazen Group was downgraded to B from B+ by S&P. Due to market weakness and Seazen's "shrinking land bank", S&P expects its 2024 sales at RMB 48-52bn ($6.6-7.2bn) vs. RMB 76bn ($10.5bn) in 2023. The rating agency noted that Seazen's business mix is shifting...

Pemex’s Dollar Bonds Rise; Debt With Suppliers Rises by 17%

Pemex's dollar bonds moved higher across the curve. While the reason for the move is not known yet, reports noted that the state-owned petroleum company's debt with suppliers rose 17.3% MoM to $9.53bn. Pemex now has $106.1bn in debts outstanding. The company has faced...

Market Sentiment Eases; CK Hutch Launches $ Bond

US Treasury yields eased slightly across the curve, by 3-4bp as markets recovered from the negative sentiment caused by Middle East geopolitical tensions. The preliminary estimates for the annualized Q1 GDP are at 2.5% vs. 3.4% during the prior quarter. The data is...

Ecuador Dollar Bonds Rise on Voters Backing Anti-Mafia Measures

Ecuador's dollar bonds continued to rise across the curve after voters backed a slew of security measures by President Daniel Noboa, in a referendum on Sunday. The president made nine proposals to fight drug and anti-mafia measures, and they were passed easily in a...

Li & Fung Downgraded to BB by S&P

Li & Fung has been downgraded by a notch to BB from BB+ by S&P. The company's senior unsecured notes and perpetual junior hybrid notes were also lowered by a notch to BB and B respectively. The rating action follows the weak operating performance by Li &...