Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

The Week That Was (05 – 11 February, 2024)

US primary markets continued to stay active, with new deals at $41.2bn vs. $28.3bn seen a week before this. IG issuers racked up $40.4bn in deals led by Eli Lily's $6.5bn six-part debt deal and Citigroup's $5.5bn two-part deal. HY issuers accounted for $5.4bn of the...

Egypt’s Dollar Bonds Rise on Abu Dhabi $22bn Beach Strip Plan

Egypt's dollar bonds rose by 1.8-2 points across the curve after reports that Abu Dhabi is in advanced talks to buy and develop premium land on Egypt’s Mediterranean coast in a project worth ~$22bn. Sources note that Egypt may retain ownership of about 20% of the...

Turkey Prices $ 10Y at 7.875%

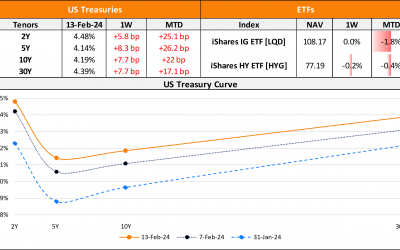

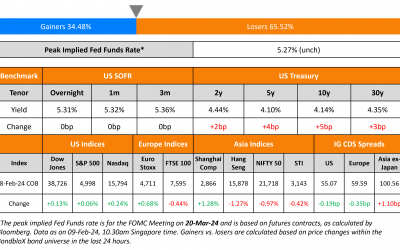

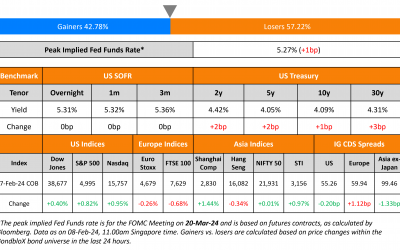

US Treasury yields continued to inch higher on Thursday with the 10Y up 5bp. US initial jobless claims fell for the first time in three weeks by 9k to 218k in the week ended February 3, below estimates of 220k. Looking at credit markets, US IG and HY CDS spreads...

Credivalores To Launch Debt Exchange Offer; Downgraded to C by Fitch

Credivalores will be launching a debt exchange offer for its $210.8mn 8.875% 2025s. It has reached agreements with its main bondholders on the terms of an exchange offer and plans to use the 30-day grace period for the coupon due 7 February 2024 to materialize these...

Fosun Plans to Revive Peak Re Stake Sale

Fosun International has revived a plan to find a buyer for its majority stake in its Hong Kong business Peak Reinsurance Co (Peak Re). As per sources, Fosun is potentially seeking a valuation of ~$1bn for the company. As part of strategic options to pay its debts, it...

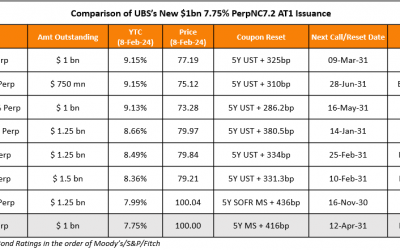

UBS Prices $1bn PerpNC7.2 AT1 at 7.75%

UBS raised $1bn via a PerpNC7.2 bond at a yield of 7.75%, 62.5bp inside initial guidance of 8.375% area. The subordinated notes are rated Baa3/BB/BBB-. The coupons are fixed until the first reset date of 12 April 2031, and if not called by then, it resets to the 5Y MS...

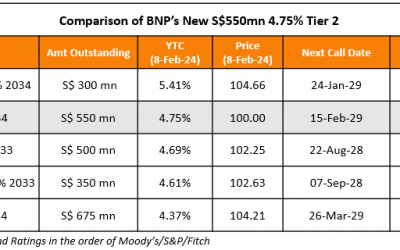

BNP Prices S$ 10NC5 Tier 2 at 4.75%

BNP Paribas raised S$550mn via a 10NC5 Tier 2 bond at a yield of 4.75%, 35bp inside initial guidance of 5.1% area. The subordinated bonds are rated Baa2/BBB+/A-. The first call date on the notes occurs on 15 February 2029. The issuer may redeem them bond at par upon...

Strong US 10Y Auction; Turkey Wealth Fund Prices 5Y at 8.375%

US Treasury yields were marginally higher on Wednesday, up by 2-3bp. The US Treasury's largest ever auction of the 10Y, issuing $42bn saw solid demand at a yield of 4.093%, stopping through (Term of the Day, mentioned below) by 1.2bp. The bid-to-cover came at 2.56x,...

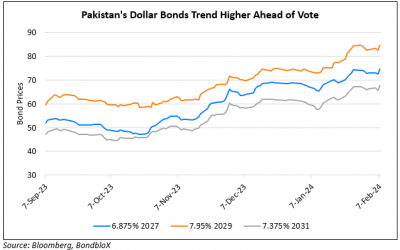

Pakistan’s Dollar Bonds Rally as S&P Sees Rating Upgrade Path

Pakistan's dollar bonds rallied by over 2 points across the curve after S&P said that it saw the nation being on a path to secure a possible upgrade to B. It said that the move would depend on whether the elections today will bring about a government that can push...