Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

BNP Paribas Prices PerpNC5 AT1 Bond at 8.5%

BNP Paribas raised $1.5bn via a PerpNC5 AT1 bond at a yield of 8.5%, a strong 50bp inside initial guidance of 9% area. If uncalled, the coupon will reset at the first reset date of 14 August 2028 and every 5 years thereafter at the 5Y US Treasury rate plus 435.4bp....

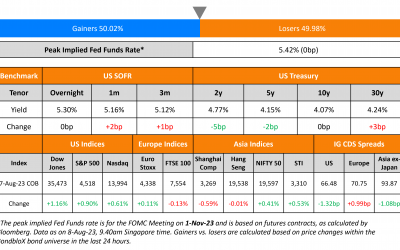

HSBC, OCBC, Goldman, ANZ Price New Issues; Macro; Rating Changes; Gainers and Losers

US 2Y Treasury yields were down 5bp while the rest of the curve held stable. Following the large selloff in US Treasuries last week, Goldman Sachs and JPMorgan have come out with calls to buy Treasuries. They believe that the sell-off especially in the 10Y and 30Y...

Yuzhou Announces Debt Restructuring Plan

Chinese developer Yuzhou Properties has announced its debt restructuring plan noting that it was in discussions with offshore creditors. It has offered three options: Option 1: Exchange the existing notes for new notes with a short-term maturity (STN) Option 2:...

Altice’s Bonds Jump on Plan to Tap Bond Markets in Second Half of This Year

Altice International is said to be ready to tap the bond markets in H2 2023 to address its 2025 maturities and "potentially" its debts due 2026, as per an investor call. Altice said that it was confident about delivering on the sale of its Portugal data center to...

Vedanta’s Dollar Bonds Trend Higher on Stake Sale

Vedanta Resources' dollar bonds continued to tick higher following Twin Star Holdings (promoter company) 4.1% stake sale in Vedanta Ltd. that helped raise about $481mn. Besides, a company official said that Vedanta Resources was looking to refinance $3.8bn worth of...

Egypt’s Dollar Bonds Rise on Rate Hike

Egypt's dollar bonds were higher by 1.5-2 points after the central bank hiked its policy rate by 100bp. Its deposit and lending rates now stand at 19.25% and 20.25% respectively, the highest since 2006. The rate hike was a surprise as analysts expected no change in...

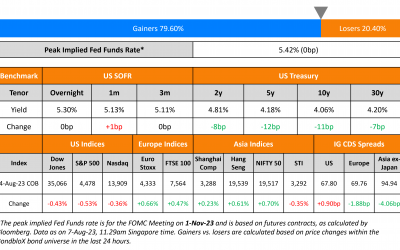

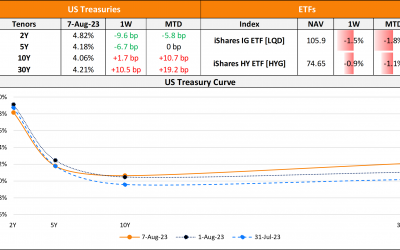

US Treasuries Rally on Softer NFP Print; HSBC, OCBC, ANZ Launch Bonds

US Treasuries rallied across the board on softer jobs growth although wage growth continued to remain sticky. The 2Y yield was down 8bp and the 10Y yield fell 11bp. US Non-Farm Payrolls came at 187k for July, lower than the surveyed 200k and slightly higher than last...

The Week That Was (31 Jul – 06 Aug, 2023)

US primary markets new deals were higher last week at $22.7bn vs. $16.7bn in deals a week prior. IG deals took the majority of volumes with $19.1bn in deals led by Columbia Pipelines' $5.6bn seven-trancher and Wells Fargo's $5bn four-part deal. HY issuers contributed...

COGARD, Vanke Report Large Drop in Sales as Liquidity Worries Persist

Large Chinese property developers Country Garden (COGARD) and China Vanke reported a sizeable drop in its July contracted sales. COGARD and Vanke reported a 60% and 35% drop in contracted sales to $1.7bn and $3.1bn respectively. Contracted sales have been weak across...