Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

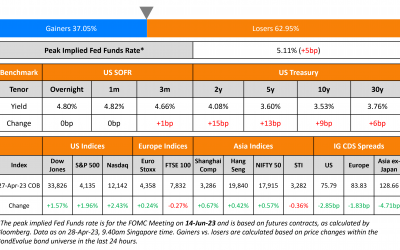

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

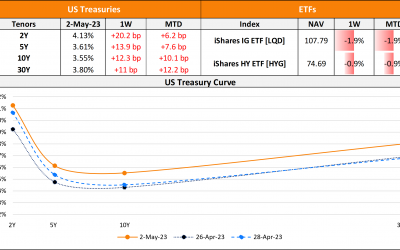

US Treasury yields were slightly higher across the curve with the US 2Y Treasury yield up 4bp to 4.13%. In just just over a month after SVB's collapse and the impact on the banking system, JPMorgan agreed to acquire First Republic Bank (FRB) in an FDIC-led deal. First...

The Week That Was (24-30 April, 2023)

US primary markets saw $14bn in new deals last week as compared to $29bn in new deals a week prior to it. Of the deal volumes, IG issuers raised $11.2bn in new issuances led by Enterprise Holdings' $3bn three-trancher and American Express's $2.5bn dual-trancher. HY...

UniCredit and Lloyds to Repay AT1 Bonds

UniCredit and Lloyds Group said that they will repay their AT1 notes that are callable in June. UniCredit said that it would redeem its €1.25bn 6.625% Perp in June after receiving supervisory approval, adding that it would not need to issue similar debt for...

Bombardier Upgraded to B from B-

Bombardier was upgraded to B from B- by S&P citing "solid operational and financial execution" that should "support sustainable deleveraging". Bombardier exceeded its targets for revenue, earnings, free cash flow, and debt repayment through 2022, S&P said....

CCRE Downgraded to RD on Exchange Offer Completion

Central China Real Estate (CCRE) was downgraded to RD from C upon the completion of its exchange offer and consent solicitation. As part of the exchange offer, CCRE decided to accept: $237.275mn in principal of its 7.25% April 2023s, $348.013mn of its 7.65% August...

Macau Revenues Shoot Higher in April

Gaming revenues in Macau soared higher by 450% YoY to a 3Y high thanks to a sharp revival in Chinese tourism to the gambling capital. Gross gaming revenue touched MOP 14.7 ($1.8bn), the highest monthly revenues since January 2020. However, Bloomberg notes that the...

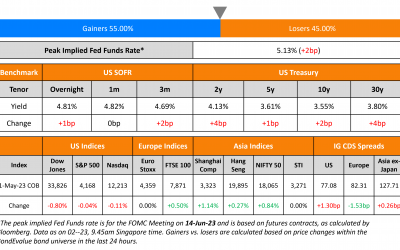

Treasury Yields Spike Higher; Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

US Treasury yields shot higher across the curve following the economic data release yesterday that showed Core PCE rise alongside a fall in applications for unemployment benefits. The US 2Y Treasury yield is now back above 4%-mark at 4.08%, higher by 15bp. The 10Y...

Adani Group Planning to Raise $700-800mn for Green-Energy Projects, Say Sources

Adani Group is said to be in talks with 12 global banks to raise about $700-800mn for new green energy projects, as per sources. If the deal comes through, this would be the Indian conglomerate's biggest borrowing since Hindenburg Research's report in January that...

Greenland Tells Bondholders March Coupons Are Being Remitted

Representatives of Greenland Holdings have told some bondholders that the developer is in the process of remitting funds offshore to pay coupons on its 6.75% 2025s that were due March 26. The notes have a 30-day grace period before the missed coupon worth $17mn is...