Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

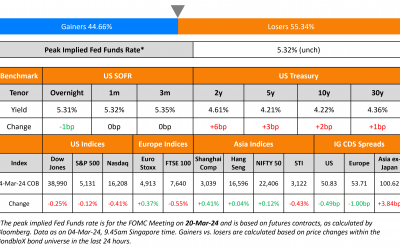

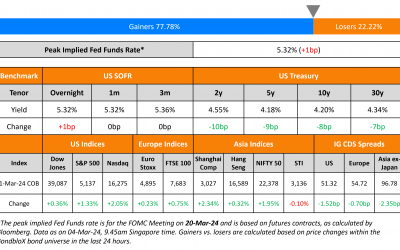

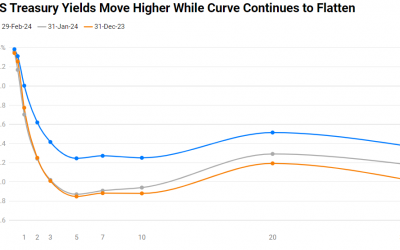

HSBC Launches S$ Tier 2; Treasury Yields Climb Up on Bostic’s Comments

US Treasury yields inched higher across the curve following the comments by Atlanta Fed President Raphael Bostic. He said that there was no urgency to cut rates thanks to the US economy's strength, noting that it would likely be appropriate for the Fed to approve two...

Instituto Costarricense Upgraded to BB by Fitch

Instituto Costarricense de Electricidad (ICE) and its senior unsecured debt were upgraded by a notch to BB from BB- by Fitch. The rating action follows Costa Rica's sovereign upgrade by Fitch last week. According to Fitch, ICE ratings are strongly linked to Costa...

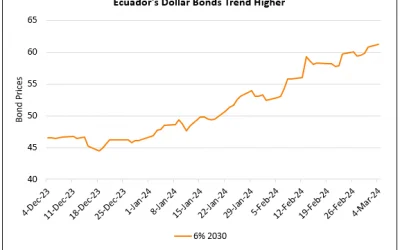

Ecuador’s Dollar Bonds Rise on Nearing IMF Deal

Ecuador's dollar bonds gained by over 1.5-2 points after a source reported the nation's President Daniel Noboa said that his government expects to reach a deal with the IMF in the next two months, during an investor meeting in New York. The President said that talks...

Macy’s Buyout Bid Raised by 14% to $6.6bn

The buyout bid for Macy's from Arkhouse Management and Brigade Capital Management has been increased by 14%, from the earlier $5.8bn to $6.6bn. This comes after Macy's rejected the earlier offer noting that the valuation was too low. "The Macy's Inc Board will...

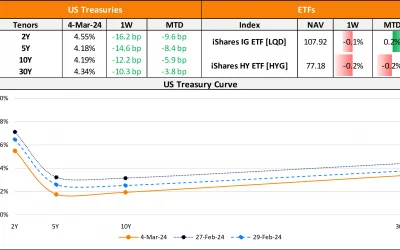

Treasury Yields Dip on Soft ISM Manufacturing

US Treasury yields dropped across the curve, with the 2Y down 10bp to 4.55% and the 10Y down 8bp to 4.20%. This move lower in yields came after the softer than expected ISM Manufacturing print. The ISM Manufacturing Index came at 47.8 in February, lower than...

NWD Sells Stake in Hong Kong Mall for $514mn

New World Development (NWD) has sold its stake in D-PARK shopping mall in Hong Kong for HK $4bn ($514mn) to ChinaChem group, according to a statement released by the company on Friday. This development follows the company's plan to trim its $1bn of non-core assets,...

LATAM Airlines Upgraded to B+ by S&P

LATAM Airlines along with its senior secured debt has been upgraded by a notch to B+ and BB respectively by S&P. The rating action follows the sharp improvement in the airline's credit metrics during 2023 and S&P's expectations that they will remain in good...

The Week That Was (26 February – 03 March, 2024)

US primary markets continued to stay active, with new deals at $38.1bn vs. $55.3bn seen a week before this. IG issuers racked up $34bn in deals with Aon North America's $6bn five-trancher and Prologis Targeted $2bn two-part deals leading the tables. HY issuers...

February 2024: Dollar Bonds Drop Amid Higher For Longer Rate Expectations

February 2024 was a relatively poor month for bond investors with 74% of dollar bonds ending lower (price returns ex-coupons). However, looking deeper, about 52% of High Yield (HY) bonds ended higher and outperformed Investment Grade (IG) bonds, where 83% of IG bonds...