Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

QIB, Macquarie, Nordea Price Bonds

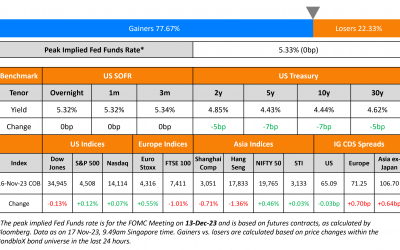

US Treasury yields edged lower yesterday, reversing the pick-up seen a day prior. Yields were down 6-7bp across the curve. Initial jobless claims for the prior week rose by 13k to 231k, higher than forecasts of 220k. The Peak Fed Funds Rate was unchanged. US credit...

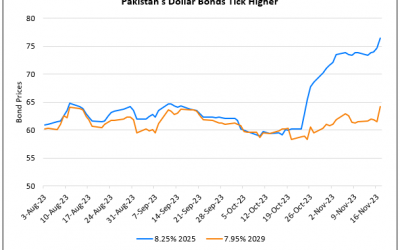

Pakistan’s Dollar Bonds Jump on IMF Agreement

Dollar bonds of Pakistan were among the top gainers, after rallying by received a $700mn agreement from the IMFs executive board. Once the approval is given, the total disbursements under the IMF's overall $3bn bailout program to help Pakistan would touch $1.9bn.

Barclays Prices $1.75bn PerpNC6 AT1 at 9.623%

Barclays raised $1.75bn via a PerpNC6 AT1 bond at a yield of 9.623%, 37.7bp inside initial guidance of 10% area. The bonds have expected ratings of Ba1/BB-/BBB- and received orders of ~$22bn, about 12.5x issue size. If uncalled between its first call date in December...

Santander Launches $ Perps at 10% area

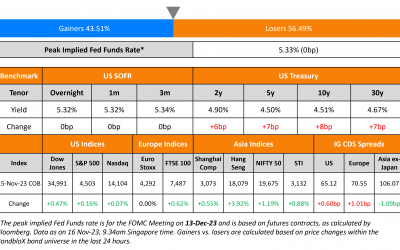

US Treasury yields moved higher by 6-7bp across the curve on Wednesday, after having dropped by more than 20bp a day prior. US Retail Sales fell for the first time in seven months, by 0.1% in October vs. a pick-up of 0.9% in September. Core Retail Sales rose 0.2% last...

Pakistan’s Dollar Bonds Inch Up on $700mn IMF Agreement

Pakistan has reached a staff-level agreement with the IMF in its first bailout review, having received a $700mn approval from the fund’s executive board. The total disbursements under the program would almost touch $1.9bn following the $700mn approval. In June, the...

Wynn Resorts, Macau Upgraded to BB- by S&P

Wynn Resorts and Wynn Macau were upgraded to BB- from B+ by S&P. The rating agency cites the recovery in the gaming mass market to support deleveraging and help reduce Wynn's debt-to-EBITDA to low-5x by end-2023 and below 5x in 2024. Its gross gaming revenues...

Huarong’s Dollar Bonds Rise on Buying 5% Citic Stake

China Huarong's dollar bonds rose by ~1 point across the curve after reporting that it bought a 5% stake in Citic Ltd for HKD 13.6bn ($1.7bn) at HKD 9.35 ($1.2) per share. This was a 29% premium to its closing price on Wednesday. Huarong said that the purchase would...

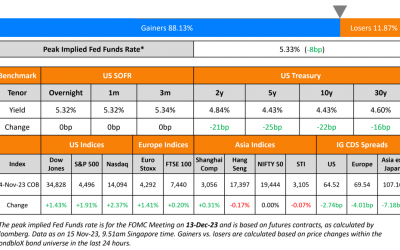

Treasury Yields Drop by 20bp on Softer Inflation

US Treasuries saw a massive rally across the curve, after a softer than expected inflation report. Treasury yields fell by over 20bp across the curve on Tuesday. US Headline CPI for October 2023 rose by 3.2%, lower than expectations of 3.3% and the previous month’s...

Burgan Bank to Sell 52% Stake in Turkish Unit; Dollar Bonds Jump

Burgan Bank has agreed to sell a 52% stake in its Turkish unit, Burgan Bank Turkey to Al Rawabi United Holding. Burgan Bank would continue to maintain operating control over unit and consolidate it in its financial results. The stake sale is expected to be concluded...