Register Now For a 14-Day Free Trial to Search and

Track Corporate Dollar Bonds

(no card details are required)

Cemex Lining Up New Dollar Bond

Mexican cement company Cemex is planning to issue perpetual dollar bonds on its second sale in the international bond market this year. The planned perpetual deferable and subordinated hybrid securities have an expected rating of B, three notches below its issuer...

Guacolda Energia Downgraded To B+ From BB-

Guacolda Energia S.A.’s ratings have been downgraded to B+ from BB- by S&P Global Ratings and its ratings have been placed on CreditWatch with a negative implication. The downgrade was driven by higher cash volatility expectations, given that Chile aims to phase...

Keppel Raises S$300mn Via PerpNC10 at 3.4%

Keppel Infrastructure Trust raised S$300mn via a Perpetual non-call 10Y (PerpNC10) bond at a yield of 4.3%, 25bp inside initial guidance of 4.55% area. The bonds are unrated. Keppel Infrastructure Fund Management, as trustee-manager of Keppel Infrastructure Trust,...

SIA Clarifies Privatisation Plans; S$6.2bn From Convertibles To Last Through 2023

Days after Singapore Airlines (SIA) was questioned on its privatization plans from investor watchdog SIAS, the airline has clarified that it is not a matter for SIA to consider, given that it is a shareholder action. SIA added that the proceeds from its Mandatory...

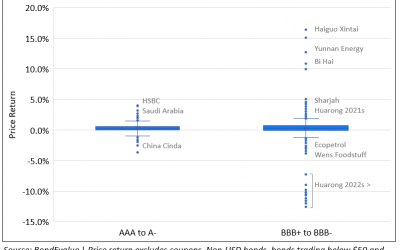

66% of Dollar Bonds Traded Higher in May 2021 with IG Outperforming

The month of May continued April's trend with 66% of dollar bonds in our universe delivering a positive price return ex-coupon during the month. Bond investors are on track for an upbeat Q2 after a dismal Q1, especially in February and March when 66% and 82% of dollar...

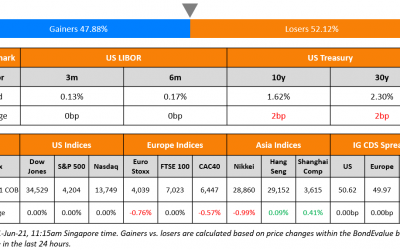

Zhenro, Keppel Launch New Bonds; Macro; Rating Changes; New Issuances; Talking Heads; Top Gainers & Losers

While US and UK markets were shut, the broader European markets fell with DAX down 0.7% and CAC down 0.6%. German inflation shot up to 2.4%, its highest since October 2018 mainly due to a 10% YoY rise in oil and energy prices. OECD raised the growth forecast for the...

Serba Dinamik Downgraded to B- by S&P on Reduced Funding Access

Serba Dinamik has been downgraded by two notches to B- from B+ by S&P this morning. The rating agency cited "reduced funding access" as the reason for the downgrade and placed the Malaysian corporate on CreditWatch Negative. S&P added that the company faces...

Mapletree North Asia Raises S$250mn via a PerpNC5 At 3.5%

Mapletree North Asia Commercial Trust (MNACT) raised S$250mn via a Perpetual non-call 5Y (PerpNC5) bond at a yield of 3.5%, 20bp inside initial guidance of 3.7% area. The bonds were unrated and received orders over $1.1bn, 4.4x issue size. Private banks bought 60% and...

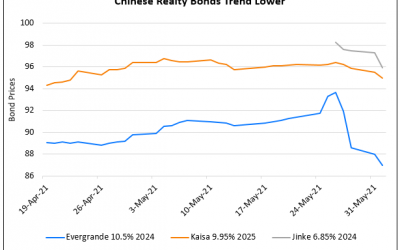

China Property Developers’ Bonds Trend Lower

Bonds of Chinese property developers trended lower led by China Evergrande, whose bonds have been moving lower for the last four days after a Caixin report stated that the regulator CBIRC launched a probe into the company’s transactions with Shengjing Bank Co. Besides...